The Federal Reserve Considers Rate Cut Talks in Light of the Uncertain Economy.

With the Federal Reserve preparing for its next meeting on January 30 and 31, all eyes are on potential interest rate decreases and the tactics that decision-makers could use. In order to maintain stability and prosperity, Federal Reserve Chairman Jerome Powell and his colleagues must tread carefully in the unpredictable economic environment.

In an effort to learn more about the Federal Reserve’s monetary policy position, investors are keenly awaiting any prospective interest rate reductions. But Powell and his group appear to be proceeding cautiously, prioritizing the establishment of a strong economic base before executing any big decisions.

Although it is anticipated that the Federal Open Market Committee (FOMC) would keep interest rates unchanged at its meeting in March and going forward, the real focus is on the future. Although policymakers have alluded to talks about cutting rates, everyone agrees that waiting for hard data on inflation trends is essential.

Mary Daly, the president of the San Francisco Federal Reserve, stressed that it is “premature” to think about interest rate reductions in the near future, emphasizing the necessity of a steady trajectory toward the Fed’s 2% inflation target. Analysts, like Ellen Zentner, the head US economist at Morgan Stanley, predict that the first rate decrease may occur in June, underscoring the Fed’s cautious and methodical approach.

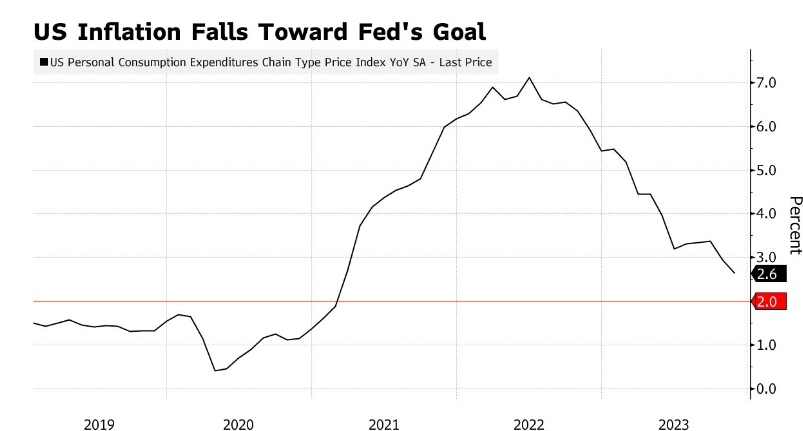

The Federal Reserve is reacting to a sharp decline in inflation from its high 1-1/2 years ago, in contrast to past rate reduction that offset economic declines. Powell and his associates understand how important it is to properly adjust policy in order to deal with this particular economic difficulty.

In a recent speech, Fed Governor Christopher Waller voiced confidence in the current situation of the economy, pointing to strong labor markets, high economic activity, and a slowdown in inflation to 2%. He broke with previous quick rate decreases by emphasizing the need to proceed cautiously.

History is a warning book; the 1970s showed what happened when loosening policy too soon before inflation was completely under control. In 1980, even the renowned central banker Paul Volcker encountered difficulties, underscoring the dangers of making hasty policy adjustments.

President of the Atlanta Fed Raphael Bostic shared the cautious sentiment, highlighting the unfavorable nature of a rate adjustment cycle. The Fed wants to avoid a situation where rates are cut and then hiked again in the event that inflation spikes back up. This might cause instability in the economy.

Economist Claudia Sahm speculates that the Federal Reserve may wait until May to lower interest rates, but once it does, things might move quickly. If inflation stays under control, Sahm sees possible 50 basis point reductions in the second part of the year.

Next Friday, officials will get the latest information on inflation, and on Thursday, they will get a preview of the GDP for the fourth quarter. Chief US economist at Bloomberg Economics Anna Wong expects the Federal Reserve’s preferred inflation gauge’s core metric to remain below 2%, which supports the cautious stance.

In its post-meeting statement, the FOMC must decide whether to provide forward guidance or to revert earlier suggestions of possible rate hikes. The recent surge in the stock and bond markets, driven by reduced interest rate expectations, could impact the committee’s choice of future policy measures.Although the financial situation has improved, Dallas Fed President Lorie Logan emphasized the need to be cautious and acknowledged the prospect of another rate hike.

The presidential election in November casts a shadow over all of these factors. Even if some economists oppose having direct control over monetary policy, the Federal Reserve might nevertheless come under fire during the election season, especially if rate decreases are thought to favor certain politicians.

Finally, the discussions held by the Federal Reserve highlight the difficulties in striking a balance between political concerns, inflation control, and economic stability. In order to make well-calibrated judgments that guarantee continued economic development while avoiding the traps of previous policy blunders, Powell and his colleagues must negotiate a challenging landscape. The Federal Reserve’s cautious stance indicates a commitment to carefully and diligently navigating the economy through unfamiliar seas, even in light of the uncertain road ahead.

You may also Read our Finance, World News, Local News, Health, Food, and Education articles.

খাসটাইমস বাংলা সম্পর্কে আরও বিস্তারিত ও নতুন খবর জানতে ক্লিক করুন। সব ধরনের ব্রেকিং, আপডেট এবং বিশ্লেষণ সবার প্রথম বাংলায় পড়তে ক্লিক করুন।

Disclaimer: The data presented in this content is derived from publically accessible online sources. Despite our best attempts to assure accuracy, the data may not always reflect real-time conditions and is subject to change. Before drawing conclusions from information, it is advised to independently check the facts and speak with pertinent sources.